Success in real estate investing and developing has many nuances to it.

Success in real estate investing and developing has many nuances to it.

The first, and said to be the only rule of real estate has always been ‘Location, Location, Location’.

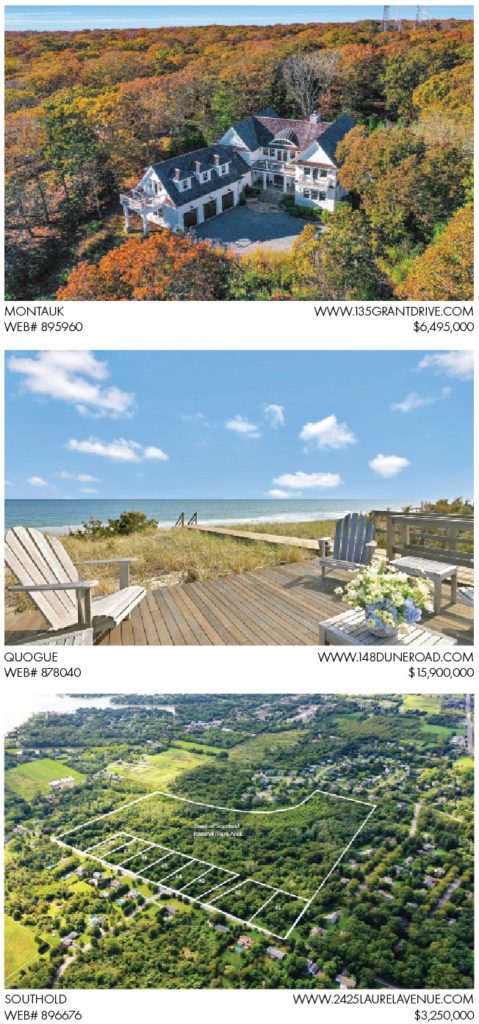

In the case of the East End, we are fortunate to have ‘location’ in all markets. Even areas distanced from Main Street or non waterfront, they all have their individual audiences. Obviously, certain markets have greater audiences than others.

Suffice it to say, we can put that rule on the shelf since our unique markets are surrounded on three sides by water, a short distance from one of the greatest cities in the world, and natural beauty not seen in many places. Location, Location, Location.

Therefore, on the East End the BIG 3 Rules ‘Check, Check, Check’.

Another factor that increases the degree of success in Real Estate investing and developing, many point to ‘timing’, but much like timing the stock market, this is not a perfect science. Yet, there are contrarians who look forward to ‘down markets’.

History tells us just about any purchase of East End dirt yields considerable gains, long term.

History also tells us contrarians reap big rewards.

Contrarians sell when they’re buying and buy when they’re selling! You can’t control the market swings, but you can wisely pounce when opportunity affords itself.

One big word of caution – leverage. If it’s OPM (Other People’s Money) it may seem easier to gamble but too many times I have seen over leveraged investors lose because they lacked staying power. Getting in and out of real estate investments is not like stocks — you can’t hit the button and sell. It’s imperative that you be able to ride out certain market swings.

“To be successful, know what you are doing, love what you are doing, and believe in what you are doing,” Will Rogers.