The big question is – what will 2012 bring in business – besides the health and peace we all hope for – especially in the Real Estate Market?

Is an investment in Real Estate a good one right now on the North Fork? In this blog I will try and provide a lot of information to allow you to come to one conclusion – besides the shear enjoyment of a (second) home in our beautiful East End region, an hour and a half outside of Manhattan’s mid-town tunnel…: YES!

Who would have thought that the budget deficit in Greece would affect the sale of your home in the US? With the huge amount of news we are bombarded with on a daily basis, what should we pay attention to (and what not) to make smart decisions? We need to incorporate in our decisions 1) a bit of economic history, 2) some international economic news , 3) US economic factors and finally, and 4) very local real estate concepts as all real estate in the end is hyper local.

The fall of Lehman in the fall of 08 was a first calamity, a tip of an iceberg making the world aware of unprecedented inter-connectedness caused by economic globalization. A globalization providing challenges but importantly also overall benefits for all participants – often overlooked in analysis. The USA and its “American Dream” tie more than any other country the success of its citizens to home ownership. A great system where banks provide mortgages, then re-sell them (to semi Government entities or private parties), and sell more mortgages allowing people the American Dream is unique in its multiplying effect in any developed world economy. The larger scale applications of futures (starting in the days of Aristotle to stabilize grain markets), options and and derivatives augmented this crisis of confidence and economies were thrown in unexpected tailspins. This finally resulted in doubts even in that rock of financial trust – the possibility of default in important economies’ souvereign debt as budget deficits sky rocket as a result of efforts to stabilize financial markets and stave off deep recessions world wide.

Repackaging good and bad loans and selling unscrupulous financial instruments caused an international crisis in confidence in worldwide financial markets. A crisis in general about the value of any collateral. But in three years we have come far in dealing with these issues, and I think the corrective pendulum swung to far and is about to swing back to the middle! Let’s not throw out the baby with the bath water when looking at the causes of economic troubles of 2008, and better understand and appreciate the improvements in the world ecomomy seen today. Let us not overlook the fact that these same maligned instruments properly applied provide businesses a stable planning opportunity, and that smart people profit even when markets go down. Isn’t it just unfair manipulation of markets to achieve such profits that we should be wary of? Hedgefunds in the US and worldwide use this principle-as flow of capital is more important in today’s world economy than production of goods and services. My point: not all effects of more complicated financial instruments are bad.

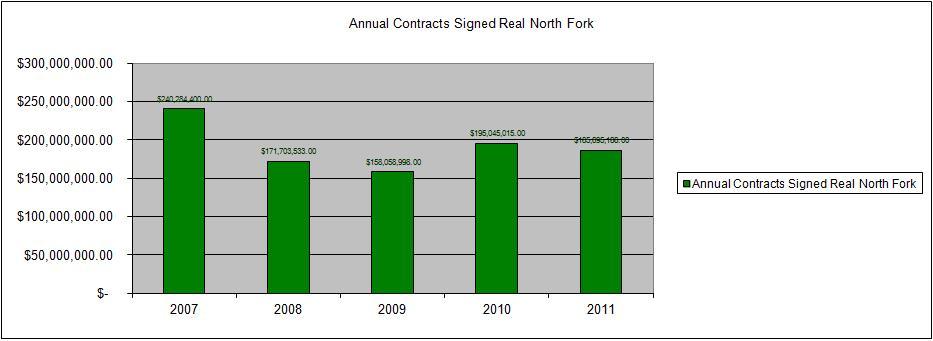

The good news in the US economy is – the doomsayers didn’t get their way in 2011 – but neither did the bulls. The economy remained flat and since August 2011 the European Souvereign debt crisis seems to dominate any economic news even today. But the news is getting better. Unemployment is finally improving – important precursor to a better Real Estate market. On the East End the bottom did not fall from under the Real Estate market, quite the contrary. As the following graph shows, the market has remained flat but has remained at much higher levels in tranactions and values than all the bad news would suggest- so is the glass half full or half empty? Data suggest it’s filling up again.

Annual Real Estate Sales – Contracts Signed – North Fork

With respect to international news: the truth is: nobody knows for sure what the future will bring. But (according to Onno Ruding, past Treasury Secretary in the Netherlands, Executive Director for IMF, and executive at Citibank) when one looks at the balance of payments for the entire Euro zone things do not look as bad as one would expect from the news – hence the Euro which has not collapsed at all and is stable strong in a range of $1.20-$1.40 to the US Dollar (only a decade ago at 1:1 and nobody thought anything of it). German, Dutch and Finnish Unemployment all are at a long term low. In effect, this crisis of confidence has given rise to the idea of a “German Euro”, and a “Greek Euro” on the other side of the spectrum. The Euro is a strange hybrid of a monetary unity without economic and political unity for the sake of national souvereignty (mostly France’s identity). So is all the Euronews exeggarated in its influence on the US Economy and the US housing market? The fear and a doomsday scenario would be that a failure in Greece’s ability to meet its souvereign obligations might cause a domino effect to Portugal, Spain and Italy, and even France. But short of that happening, a default of just Greece would-worst case- not be catastrophic but quite manageable. I think you can make that case easily – as long as we do not see major unforeseen calamities in 2012, in which case all predictions fail.

In August, the Chief economist for NAR , Lawrence Yun spoke before the NYSAR conference and made an interesting statement: housing starts are not keeping up with household growth for the past three years, possibly creating a housing shortage if trends continue. Might I add that I think that the US consumer is plain tired of bad news – showing up in droves at the stores in the 2011 Holiday Shopping season?

All Real Estate is local, and everyone knows the saying “location, location, location”. So let’s look at the local facts first. I keep track of an interesting statistic: RE contracts signed, in what I call the “Real North Fork” market area, about from Rte 105 East. Please do not hold this statistic to precise measures, as it is very volatile, but the advantage is that it gives you a very quick overview of what the reports on closings later will tell you more exactly, it is a measure of the activity of RE sales in our market with very little delay. A great predictor.

Pictures speak louder than a thousand words, and the facts speak for themselves:

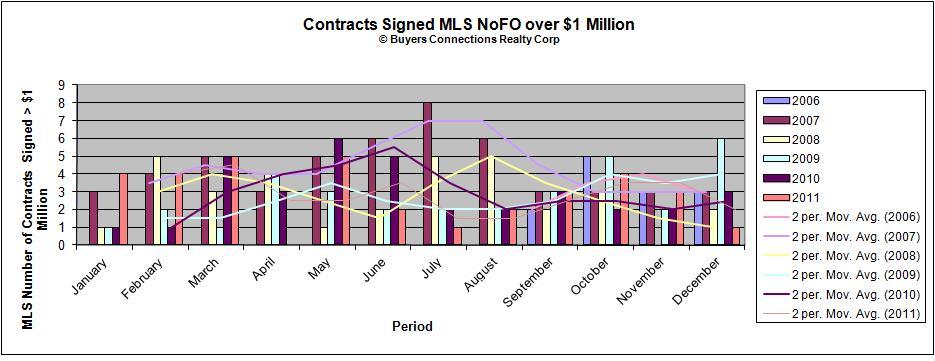

Residential Sales Contracts Signed North Fork – Over $ One Million – (from MLSLI)

2011 saw 34 transactions over $1 Million, vs 35 in 2010, 33 in 2009 and 2008, and 52 in 2007. The upper end of the market has undoubtedly stabilized. I have seen some very good prices fetched for very good properties – almost comparable to the top of the market in the most spectacular homes segment.

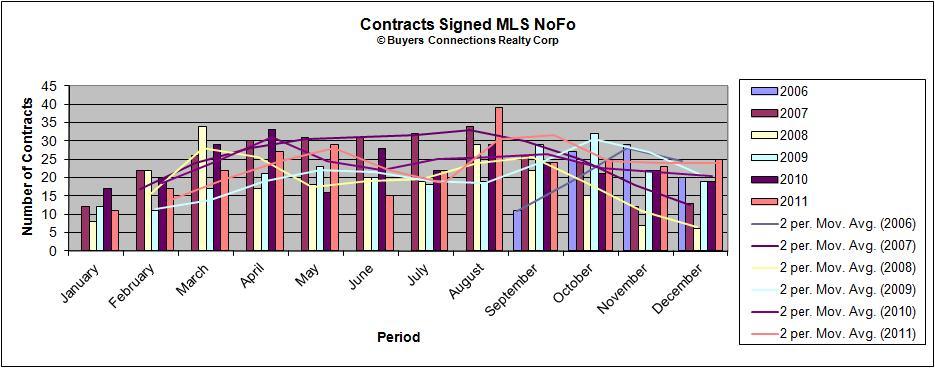

Number of Residential Contracts of sale signed in New York’s North Fork Wine Country

2011 saw 279 transactions vs 280 in 2010, 243 in 2009, 217 in 2008, and 293 in 2007 but this story is not complete without a picture of the median price and days on market:

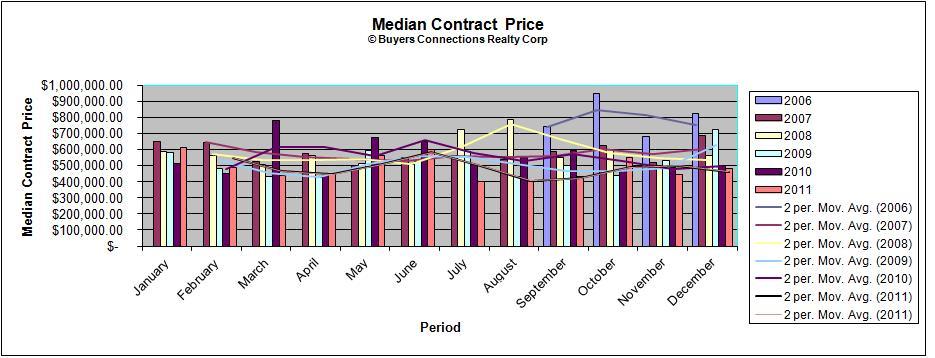

Median Prices Contracts Signed North Fork Wine Country

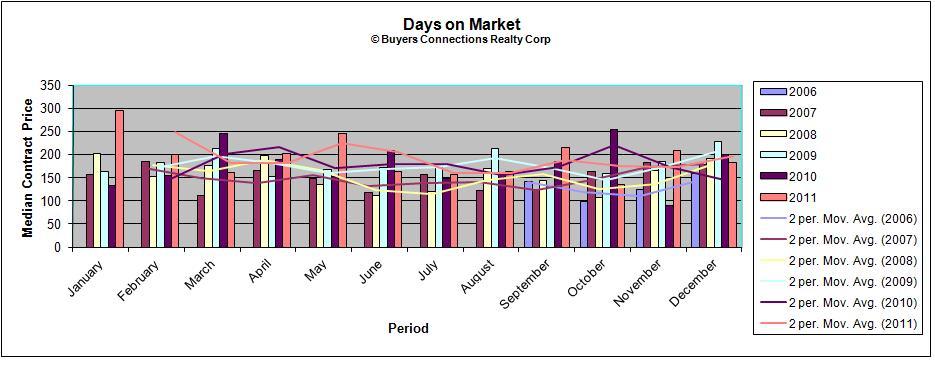

Days on market before contracts were signed

The North Fork Market stabilized in the Summer of 2010. The full picture would indicate that properties for which contracts were signed seem to have taken longer to get to that point – but any experienced Real Estate broker will tell you that a well priced property sells quickly as there are buyers out there looking for opportunities. The median price of homes sold also is at the bottom of the three years as expected: it is either a beauty contest or a price war – and the buyers still have the upper hand here.

To make the right decision, and benefit from the trends these data show, follow our North Fork T&C experience in this market:

Tips for sellers: your pricing decision will determine if and when you will sell. This is what I would consider if I were selling my house: A good Realtor (r) will help you get first prize in the “beauty contest” and suggest ways to present your property in the best light. Make sure you Realtor (r) works full time – so any buyer can reach him or her easily, and so the home can be shown promptly and easily to buyers when they are available. Also make sure your Realtor makes use of the best technology available. Look at the way their listings show online before choosing an agent. And like-it-or-not: statistics show that most buyers today will find the property they are going to buy online. Feel free to use our Town and Country Website as a standard: again, a picture speaks louder than a thousand words and our state-of-the-art web technology showcases your home beautifully. Ask the question: where will your buyer come from? Does your agent have the wherewithall to reach that buyer? Is there a fit between his or her personality and the buyer you are trying to attract? Is the way this agent markets other properties attractive to that buyer for your home? In the end luck will play a role, but you can reallly improve your odds by selecting the right agent and the right RE company. If you were a buyer – would you enjoy looking at homes with this agent? Is he or she enthusiastic, happy, and a goal getter? All characteristics we look at before we ask associates to join Town and Country Real Estate.

Sellers: things are probably not going to get better quicklier than your running expenses if you hang on. Make use of the fact there’s a lot less market competition now with fewer properties on the market. And think of it this way: if you are going to make use of any buying opportunities after you sell- best to grab them now, so better to sell now and not wait! The only good reason to take a property off the market is if you do not want to sell. And buyers can afford your home now better now than in the (nearer) future- you can almost take that one to the bank.

Tips for buyers: work with a Realtor (r) who knows the market and loves Real Estate – only then will he or she be able to tell you which homes are the ones that you want to look at, know the ins and outs of each home, and allow you to use your time efficiently. You want to be ahead of the curve – once everybody catches on that the worst is over – you will be too late for the best time to buy. Come prepared with a mortgage pre-approval in hand. Be available and ready to go when a home pops up (either new on the market or suddenly lowered to the right price) – for a great deal you will have competition from other buyers and you need to be quick and ready to compete. This morning only 397 homes showed up on MLS, in a market area where normally 550 homes are on the MLS. So be prepared to act. Waiting will not get you a better deal – so if you find what you are looking for and the price is right – buy now while interest rates are still low.

To buy or not to buy is the question, or for sellers: to sell or not to sell. Buyers may have to pay higher interest rates if they wait longer, and I see prices going up. So buyers who are going to “wait and see” may well have to pay for that privilege. And don’t forget – what banks think buyers can afford will go down very quickly under that scenario.

Town and Country is excited to report that we are experiencing remarkable growth and development in this challenging market. Our T&C agents have helped more buyers and sellers succesfully conclude deals on the North Fork than ever before. December was the busiest month of December most of our agents can recall. Our careful selection of professionals to service your needs is responsible for that. Call us if you are interested in joining us in our success, to buy, sell, or rent, in our Mattituck office at 631 209 0600 or Southold office at 631 765 0500! At Town and Country Real Estate – we are quietly getting the job done.