For the week of Nov 09, 2009 // Vol. 7, Issue 45

Last Week in Review ![]()

“TIME IS MORE VALUABLE THAN MONEY. YOU CAN GET MORE MONEY, BUT YOU CANNOT GET MORE TIME.” Jim Rohn. And while this is certainly true, home buyers and folks receiving unemployment benefits both got the word that a bit more money and time is coming their way.

Just on Friday, President Obama signed into law a bill that extends unemployment benefits and the First Time Home Buyers tax credit, which is also being expanded to include benefits for homebuyers who aren’t on the first time around buying a home. If purchasing a home is in the cards for you or anyone you know, you can get all the details of the homebuyer’s tax credit in this week’s Mortgage Market Guide View article below. But first, here are a few additional highlights from last week…including important job market news.

Last week’s official Jobs Report showed that there were 190,000 jobs lost in October, higher than the 175,000 job losses that were widely expected. In addition, as you can see in the chart below, the Unemployment Rate rose to 10.2%, quite a bit higher than the 9.9% expected, and the highest Unemployment level since 1983.

Chart: Unemployment Rate

While this number is bad, what is even more concerning is the “real” unemployment rate being closer to 17.5%. This includes those who have not searched for a job for at least four weeks, known as “discouraged or detached” workers, as well as those desiring full time work but having to settle for part time, the “underemployed”. The only ray of sunshine within this anemic report were the upward revisions for August and September, showing 91,000 fewer jobs lost than previously reported.

Let’s remember, in order to just keep up with population growth – or to keep the ranks of the unemployed from rising – there must be 125,000 jobs created each month. So the latest report of 190,000 jobs lost, really means we have fallen behind by 315,000 jobs, just last month.

In other news, Pending Home Sales for October were reported up 6.1%, mostly attributable to First Time Home Buyers rushing to get into contract before the original November 30, 2009 expiration date for the $8,000 tax credit – again, see below for details on the tax credit extension and expansion. Also last week, the Fed issued its latest Policy Statement without any big changes or surprises.

Remember, weak economic news typically causes money to flow from Stocks into Bonds, helping Bonds and home loan rates improve. Bonds struggled through the middle part of the week but were able to rally Friday on the heels of the poor Jobs Report. As a result, Bond prices and home loan rates ended the week slightly better than where they began.

TAKING THE TIME TO REALLY UNDERSTAND WHETHER YOU OR SOMEONE YOU KNOW MIGHT QUALIFY FOR THE EXTENDED AND EXPANDED HOME BUYER TAX CREDIT COULD MAKE A BIG DIFFERENCE…AND MANY PEOPLE ARE STILL UNAWARE THAT THIS CREDIT IS AVAILABLE! TAKE A MINUTE TO CHECK OUT THIS WEEK’S MORTGAGE MARKET VIEW FOR MORE DETAILS, AND PASS THEM ON TO ANYONE YOU KNOW WHO MIGHT BENEFIT.

Forecast for the Week ![]()

This week’s economic report calendar is much quieter than last week’s, but that doesn’t mean there won’t be plenty of action. Thursday brings another Initial Jobless Claims Report, and now that the bill to extend unemployment benefits has been signed into law, the number of Continuing Jobless Claims is likely to rise significantly. This number had been moving lower, which the media and other “experts” have been rejoicing over, not understanding that it is moving lower because so many people have been on unemployment for so long, their unemployment benefits have actually expired before they were able to find work. It’s more important than ever to keep an eye on this information, since the labor market is a key factor in our overall economic recovery.

There are more Treasury auctions ahead, and it’s yet another record amount in debt being issued. As usual, I’ll keep a close eye on how these auctions are received, particularly as some of the longer term maturities being auctioned provide competition for Mortgage Bonds…and a slowing appetite for Mortgage Bonds will contribute to home loan rates moving higher.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds were able to end the week on an improving note, and I’ll be watching closely to see if this trend continues.

Chart: Fannie Mae 4.5%% Mortgage Bond (Friday, Nov 06, 2009)

The Mortgage Market View… ![]()

Homebuyer Tax Credit Extended and Expanded!

Last week, a new Homebuyers Tax Credit bill was signed into law. The bill extends the tax credit for first-time homebuyers (FTHBs), as well as opens it up to current homeowners who are looking to buy. And even if you aren’t looking to purchase – pass on this article to anyone you think might be in the market to do so. This is information that might benefit them greatly, and I’ll be happy to be of service to them.

Here is a brief overview of the Homebuyers Tax Credit – and its benefits – based on the new bill.

Tax Credit for First-Time Homebuyers

FTHBs (that is, people who have not owned a home within the last three years) may be eligible for the tax credit. The credit for FTHBs is 10% of the purchase price of the home, with a maximum available credit of $8,000.

Single taxpayers and married couples filing a joint return may qualify for the full tax credit amount.

Tax Credit for Current Homeowners

The tax credit program now gives those who already own a residence some additional reasons to move to a new home. This incentive comes in the form of a tax credit of up to $6,500 for qualified purchasers who have owned and occupied a primary residence for a period of five consecutive years during the last eight years.

Single taxpayers and married couples filing a joint return may qualify for the full tax credit amount.

What are the New Deadlines?

In order to qualify for the credit, all contracts need to be in effect no later than April 30, 2010 and close no later than June 30, 2010. Those in the military do have some special extensions on the timelines available.

What’s So Great About a “Tax Credit”?

The benefit of a tax credit is that it’s a dollar-for-dollar benefit, rather than a “tax deduction”, or reduction in a tax liability that would only save you $1,000 to $1,500 when all was said and done. So, if a first-time homebuyer who qualified for the entire benefit were to owe $8,000 in income taxes and would qualify for a tax credit of $8,000, she would owe nothing.

Better still, the tax credit is refundable, which means the homebuyer can receive a check for the credit if he or she has little or no income tax liability. For example, if a first-time homebuyer is eligible for a tax credit of $8,000 but is liable for $4,000 in income tax, she can still receive a check for the remaining $4,000!

Higher Income Caps

The amount of income someone can earn and qualify for the full amount of the credit has been increased.

Single tax filers who earn up to $125,000 are eligible for the total credit amount. Those who earn more than this cap can receive a partial credit. However, single filers who earn $145,000 and above are ineligible.

Joint filers who earn up to $225,000 are eligible for the total credit amount. Those who earn more than this cap can receive a partial credit. However, joint filers who earn $245,000 and above are ineligible.

Maximum Purchase Price

Qualifying buyers may purchase a property with a maximum sales price of $800,000.

Remember, the new tax credit program includes a number of details and qualifications. Call or email today if you have questions or would like to see if you can benefit from the tax credit…and email this article along to anyone else you feel it might benefit as well!

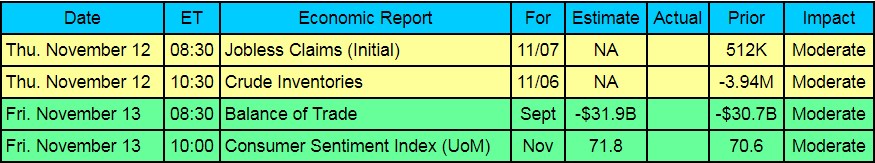

The Week’s Economic Indicator Calendar ![]()

Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise.

Economic Calendar for the Week of November 09 – November 13

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

As your trusted advisor, I am sending you the Manhattan Mortgage Company Mortgage Weekly Update because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email: ejarrett(at)manhattanmortgage(dotted)com

If you prefer to send your removal request by mail the address is:

Eve Robin Jarrett

Manhattan Mortgage

75 Main Street, 2nd Floor

East Hampton, NY 11937

The Manhattan Mortgage Company is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. The Manhattan Mortgage Company does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.