For the week of Dec 14, 2009 // Vol. 7, Issue 50

Last Week in Review ![]()

“IT’S A RECESSION WHEN YOUR NEIGHBOR LOSES HIS JOB; IT’S A DEPRESSION WHEN YOU LOSE YOURS.” Harry S. Truman. Very true words indeed – and last week brought some market action when Fed Chairman Ben Bernanke discussed the recession, commenting that our economic recovery still faces “formidable headwinds.” As you can see in the chart below, the current recession we have been in has been the longest in nearly half a century.

Chart: Post World War II Recessions

And because negative economic comments or news causes money to flow out of Stocks and into Bonds, Bernanke’s words helped Bonds and home loan rates to improve early last week…but these improvements were short lived.

Bond prices and home loan rates responded poorly to the Treasury auctions of last week, as the Treasury instruments being auctioned off are in direct competition with Mortgage Backed Securities…and the continual record amounts of supply hitting the market requires record amounts of buying to take place as well. And remember – the Federal Reserve is winding down their Mortgage Backed Security purchasing program, so as they stretch out and ration their remaining purchases through the first quarter of next year, the reduced amount of their buying just adds to the problem.

And as with any item, when there is lots of supply and diminishing demand – Economics 101 tells us that the price of that item will subsequently go down. So as Bond prices go down, home loan rates go up – and last week saw home loan rates increase by at least .125% across the board.

Also adding to selling pressure on Bonds in the latter part of last week were several bits of good economic news. First, the Retail Sales Report for November was better than expected, marking the third monthly increase over the past four months. It appears that lower prices and good deals are helping to spur some buying activity, though it remains to be seen how this will impact retailers’ bottom lines. Consumer Sentiment was also reported quite a bit better than expected.

>AND SPEAKING OF RETAIL SALES AND CONSUMER SENTIMENT – ARE YOU STILL WONDERING HOW TO WISELY SPEND YOUR HARD EARNED DOLLARS WHILE HOLIDAY SHOPPING THIS YEAR…AND STILL FEEL GREAT ABOUT HAVING GIVEN A GREAT GIFT? CHECK OUT THIS WEEK’S MORTGAGE MARKET VIEW FOR GREAT HOLIDAY GIFT IDEAS UNDER $25.

Forecast for the Week ![]()

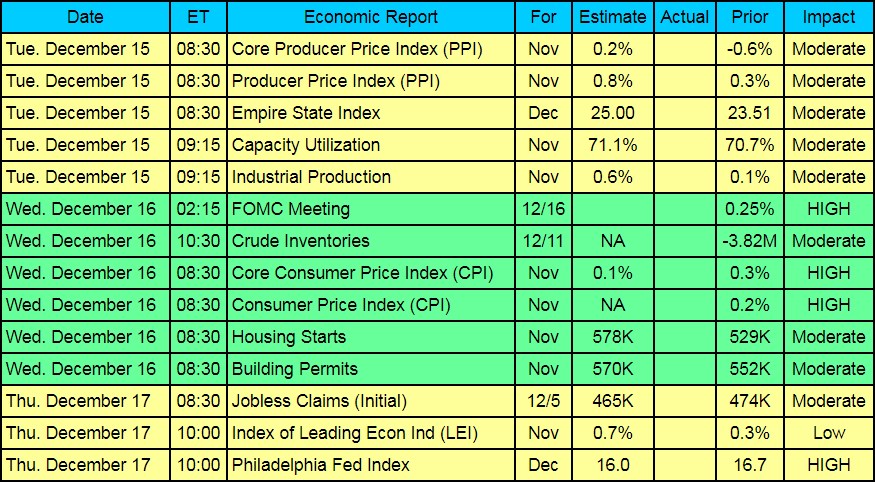

Last week may have been a slow one when it comes to economic reports, but the week ahead is full of action, beginning with Tuesday’s Producer Price Index (PPI) Report, which measures inflation at the wholesale level. More inflation news immediately follows with Wednesday’s Consumer Price Index (CPI) Report. Remember that inflation erodes the value of the fixed income that a Bond provides, so any signs of inflation can cause Bond prices and home loan rates to worsen.

Wednesday will also bring a read on the housing market with the Housing Starts and Building Permits Report, as well as the Interest Rate Decision and Policy Statement from the Fed, following the end of their regularly scheduled Federal Open Market Committee meeting. A change in rates isn’t expected – but any comments about inflation in the Policy Statement could rattle Bonds and home loan rates.

Also important this week is a look at the manufacturing sector, via Tuesday’s Empire State Index and Thursday’s Philadelphia Fed Report. Manufacturing reports have been all over the boards lately, but a marked improvement in either of these reports could cause Stocks to move higher, and in turn, hurt Bonds and home loan rates. Also in store for Thursday is another look at the weekly Initial Jobless Claims Report. Last week’s Continuing Jobless Claims fell to the lowest level since February, and while at first blush this decline would appear to be a good thing, it is likely that the numbers are reflective of people accepting part time or seasonal work that won’t last after the holidays.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and rates worsened after last week’s Treasury auctions. I’ll be watching carefully to see if Bonds and rates can muster an improving rally this week in the face of a heavy news week.

Chart: Fannie Mae 4.5%% Mortgage Bond (Friday Dec 11, 2009)

The Mortgage Market View… ![]()

Best Holiday Gifts for Under $25

The holiday season can be a strain on your pocketbook. Considering the current economic climate, it may be even more apparent this year than in the recent past. But there are still plenty of inexpensive holiday gifts you can give this year – even for under $25 – that will help ring in the holiday cheer!

Godiva Chocolate – Godiva offers a number of chocolate selections for under $25. It’s not only a delicious product, but receiving chocolate in a little gold box is about as iconic as receiving jewelry in a little blue box. Visit

Bottle of Wine – A bottle of wine is a great gift of holiday cheer. And for $25, you can buy a nice bottle.

Christmas Tree Ornament – This gift is obviously contingent on the recipient celebrating Christmas. Nonetheless, it is a thoughtful present that can be kept forever. Depending on the ornament, some can be personalized with engraved messages, as well as the year they were purchased.

Lottery Tickets – This is another inexpensive gift you should consider. The idea of scratching off 25 lottery tickets can be a lot of fun. The gift gets even better if a number of the lottery tickets pay off. Tuck them inside a thoughtful card and you’re all set.

French Press Coffee Pot – Every true coffee lover should have a French Press pot. And even if they already have one, they’ll probably enjoy another one to keep in separate locations or to be used simultaneously for larger get-togethers.

A Journal and a Pen – One does not have to be a writer in order to find countless uses for a journal and a pen.

A Board Game – From single folks to families, board games provide the perfect entertainment at a gathering with friends, or even a quiet weekend night at home.

Homemade Gift Basket – Putting together a gift basket for someone allows you to tailor the gift precisely to the interests of the person who’s receiving it. Gift basket themes are limitless and can fit into any budget.

Bath and Body Gifts – Everyone can use a little bit of pampering from time to time. With the variety of scented lotions and shower gels available today, you’re sure to find something within your budget.

Times may be tough, but that doesn’t mean you need to completely forgo the tradition of holiday gift buying. You just have to be a bit more creative. Happy shopping…and happy holidays.

www.Godiva.com to see the various selections.

The Week’s Economic Indicator Calendar ![]()

Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise.

Economic Calendar for the Week of December 14 – December 18

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

As your trusted advisor, I am sending you the Manhattan Mortgage Company Mortgage Weekly Update because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email: ejarrett(at)manhattanmortgage(dotted)com

If you prefer to send your removal request by mail the address is:

Eve Robin Jarrett

Manhattan Mortgage

75 Main Street, 2nd Floor

East Hampton, NY 11937

The Manhattan Mortgage Company is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. The Manhattan Mortgage Company does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.