For the week of Jan 11, 2010 // Vol. 8, Issue 2

Last Week in Review ![]()

“THERE ARE NO SECRETS IN LIFE, JUST HIDDEN TRUTHS THAT LIE BENEATH THE SURFACE.” From the Showtime TV hit, “Dexter”. The highly anticipated Jobs Report arrived last Friday morning, showing 85,000 jobs lost during December…and while this was a bit worse than expected, the report also carried some good news, in that the prior month’s revisions showed that November actually had a final tabulation of job gains for the month, for the first time since December 2007. Additionally, the Unemployment Rate remained stable at 10%. While this all seems to indicate some level of improvement in the labor market – you do have to look beneath the surface to clearly understand the present realities for the labor market.

Let’s start with the headline number of 85,000 jobs lost. This comes from what is called the “business survey”, which uses many estimation tools, including the birth-death ratio of businesses, i.e. how many businesses were created or closed. The mechanics in coming up with the business survey allow the information to be gathered rapidly, but it also makes the information far less than accurate. On the other hand, there is also a “household survey”, where a sampling of households receive actual phone calls. Although the household number is not used by the Labor Department for their headline numbers of job losses or creations, some deem it to be a bit more accurate. The household survey paints a bit of a darker – but perhaps more realistic – picture, showing a whopping 589,000 jobs lost. But let’s dig deeper still.

The Labor Department does use the household survey to calculate the Unemployment Rate – and remember, it stayed stable at 10% – but the calculation is determined by how many people are presently in the workforce. And the household survey indicated that last month, 661,000 people left the workforce.

Whoa – what does “leaving the workforce” mean? And where exactly are they going? Let’s take a closer look to understand.

The Labor Department’s definition of this is a “discouraged worker”, who has not looked for a job during the past four weeks. Based on this definition, there are a few contributing factors that would help us understand why this would indicate such a large number of people “exiting the workforce.” And remember, more people exiting the workforce means less people counted as unemployed, and this number alone last month would have contributed to almost a half percent increase in the rate of unemployment from 10% to almost 10.5%.

So let’s talk about these contributing factors. First, frigid temperatures and piles of snow during December played a role in keeping job seekers home. Add to that the holiday season, as well as travel for family gatherings and vacations during this time, also contributing to pushing off the job search. And perhaps most importantly playing a role are the extended unemployment benefits – up to 99 weeks worth – which could also play into the decision to not seek work. Put this all together, and it might clarify the large so-called exodus from the workforce, which masks the true Unemployment Rate.

Overall – the job picture is still weak, at best. Census hiring in the next few months – although temporary – should boost job creations, which in turn may lead to upside Job Report surprises. This could lead to some tough days ahead for Bonds and home loan rates – count on me to be watching closely, and standing by to advise.

Chart: 2009 Job Gains or Losses (In the Thousands)

IT’S NO SECRET THAT MANY AMERICANS MAKE NEW YEARS RESOLUTIONS RELATED TO THEIR HEALTH AND FITNESS – AND THE GOOD NEWS IS THAT IT CAN BE SIMPLE. READ ON FOR A MORTGAGE MARKET GUIDE VIEW ARTICLE DESCRIBING A FEW SIMPLE TRIED AND TRUE EXERCISES THAT ARE EASY…AND WORK.

Forecast for the Week ![]()

The major reports for this week start in earnest on Thursday when the Retail Sales Report arrives, being the most-timely indicator of broad consumer spending patterns. Initial Jobless Claims will also be released on Thursday, and will likely be a hot topic after last week’s weaker-than-expected Jobs Report. Friday will bring another healthy round of economic news when we get a look at the Consumer Price Index, Industrial Production, and the Consumer Sentiment Index.

We may also see some volatility depending on how the markets receive more supply…via the Treasury Department auctions of $10 Billion in 10-yr Treasury Inflation-Protected Securities on Monday, $40 Billion in 3-year Notes on Tuesday, $21 Billion in 10-year Notes on Wednesday, and $13 Billion in 30-year Notes on Thursday.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result.

As you can see in the chart below, Mortgage Bonds rallied early last week but were halted by a technical ceiling of resistance at the 200-Day Moving Average and were subsequently pushed lower, meaning home loan rates worsened.

Chart: Fannie Mae 4.5%% Mortgage Bond (Friday Jan 08, 2010)

The Mortgage Market View… ![]()

Exercises That Don’t Cost a Dime

Getting back in shape after the holidays is often tops on people’s New Year’s Resolution list. Here are some exercises you can do at home…and for free…to help kick start the new year.

Push-Ups

Tried and true, push-ups are perfect for toning the chest, triceps and shoulders. If you’re not ready for the standard military push-up, try doing them from your knees, making sure to keep your ankles crossed.

Sit-Ups

Start by lying on your back with your knees bent and feet placed flat on the floor. Feel free to wedge your toes underneath a couch or bed frame in order to keep your feet planted. With your hands behind your head, begin your sit-up. But, instead of going all the way up to your knees, stop halfway and pause before returning to the ground. Doing so alleviates tension in the lower back, while isolating the middle and upper abdominals.

Leg Lifts

Lie flat on your back with your feet together and the palms of your hands on the ground next to you. Keeping your legs straight, raise them until they are perpendicular to the ground and your toes are pointing straight in the air. This is a great exercise for strengthening and toning the lower abdominals.

Lunges

Stand with your feet spread shoulder width apart. With your hands on your hips, step forward with your right leg and take your left knee to the ground. Return to the initial standing position and step forward with your left foot, taking your right knee to the ground. Return to standing and repeat this series of moves. Increase the difficulty by holding dumbbells during the exercise. If you don’t have dumbbells, try using jugs of water or something similar from your pantry.

Dips

This is a great exercise for both your triceps and shoulders. Utilizing a sturdy chair or bench, sit at the edge of the seat with your legs straightforward, heals to the ground and toes pointing up. Your hands should firmly grasp the edge of the seat, shoulder width apart. Supporting yourself with your arms, slide your butt off the edge of the seat. Use your arms to lower yourself until your triceps are parallel to the ground. Then push yourself back up. Keep repeating this motion.

Calve Raises

On your toes, balance yourself on the edge of a bottom step. The soles of your feet, as well as your heels, should be hanging off the edge. Grab on to a banister or door jam for support and lower your heals toward the ground, as far as they’ll go. Now, raise yourself up so that you are standing on your toes. Repeat this motion. This exercise works wonders for toning calve muscles.

For all of these exercises, start with one or two sets of 10 to 20 repetitions. As you get stronger, increase the number of sets and repetitions, as well as decrease the amount of time spent resting between sets.

You’ll feel great and look great in plenty of time for summer!

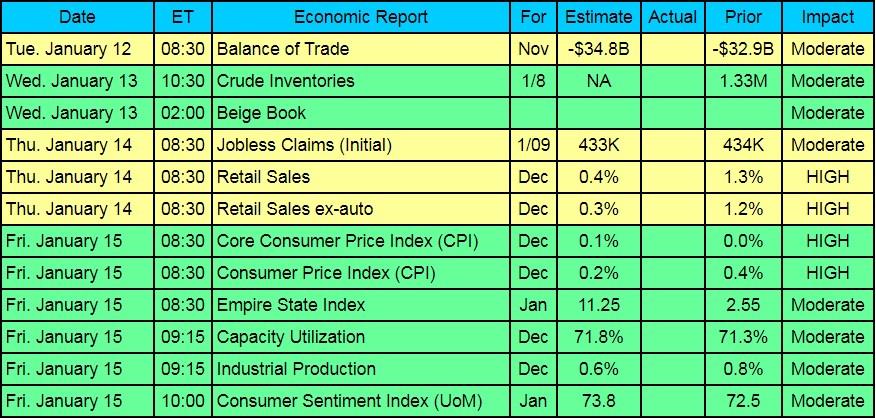

The Week’s Economic Indicator Calendar ![]()

Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise.

Economic Calendar for the Week of January 11 – January 15

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

As your trusted advisor, I am sending you the Manhattan Mortgage Company Mortgage Weekly Update because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email: ejarrett(at)manhattanmortgage(dotted)com

If you prefer to send your removal request by mail the address is:

Eve Robin Jarrett

Manhattan Mortgage

75 Main Street, 2nd Floor

East Hampton, NY 11937

The Manhattan Mortgage Company is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. The Manhattan Mortgage Company does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.