For the week of Oct 26, 2009 // Vol. 7, Issue 43

Last Week in Review ![]()

“THE DEVIL IS IN THE DETAILS…” Or so the famous saying goes. And when it comes to really understanding the various reports and events unfolding in the economy, it’s important to take a look at the details – not just the headlines. Here’s what you need to know.

On the inflation front, the Producer Price Index, which measures wholesale inflation, unexpectedly fell due to a drop in energy prices. While that seems like good news on the surface, keep in mind that next month’s number could climb higher again, as oil and natural gas have both been on a tear higher lately.

In housing news, Housing Starts and Building Permits both came in a bit below expectations, but this may be a sign that builders are exercising some caution – particularly in the face of the $8,000 tax credit for first time homebuyers that is presently set to expire on November 30th. Existing Home Sales came in better than expected – and a whopping 45% of those homes were sold to first time homebuyers – rushing to move in on that credit. Recent studies have shown that many who qualify for this tax credit aren’t even aware of it…so please let me know if you or someone you know needs more information – the clock is ticking!

Additionally, the level of existing homes inventory shrunk to a 7.8 month supply, down from a recent high of 10.1 months in April.

———————–

Chart: Existing Home Sales (Supply in Months)

In other news, 3rd quarter earnings season continues, where companies report their status as of the end of September. While many companies are beating expectations, it’s important to realize that many of those companies achieved better earnings by cost cutting and layoffs, not from increased sales. This is a big disconnect between Wall Street and “Main Street”. Stocks are rocketing higher based on these “positive” reports, but the cost cutting and job cutting measures can only go so far…you can’t simultaneously grow the ranks of unemployment – and then grow your business, hoping for increased sales to those same people who are without jobs.

Last week’s Jobless Claims numbers seem to confirm this as Initial Jobless Claims rose more than expected. In addition, the number of individuals continuing to receive unemployment benefits fell to the lowest level since March, but this is likely the result of people’s unemployment benefits expiring, without them having been able to find jobs.

Also worth noting is the news that ratings agency Moody’s lead analyst, Steven Hess, said that the US needs to cut its deficit or it could lose its “AAA” rating in the next 3 to 4 years, which we have maintained since 1917! Think of all we’ve been through – two World Wars, the Depression, three Wall Street collapses and major terrorist attacks…yet our credit quality has maintained that AAA rating, allowing us to issue debt at the most favorable rates. Hess went on to say that if the US doesn’t “get the deficit down in the next 3-4 years to a sustainable level, then the rating will be in jeopardy.” And just like on a mortgage when the credit rating gets reduced, interest rates move higher. This will definitely be something we’ll keep an eye on in the months ahead.

After all the week’s action, Bonds and home loan rates ended the week slightly worse than where they began.

AS THE PRESIDENT HAS DECLARED H1N1 – “SWINE FLU” – TO BE A NATIONAL EMERGENCY – GETTING THE FACTS IS MORE IMPORTANT THAN EVER. DO YOU KNOW HOW TO TELL WHAT’S JUST A COLD…AND WHAT IS ACTUALLY SWINE FLU? READ THIS WEEK’S MORTGAGE MARKET VIEW – AND PASS ON THE DETAILS TO YOUR FRIENDS AND COWORKERS.

Forecast for the Week ![]()

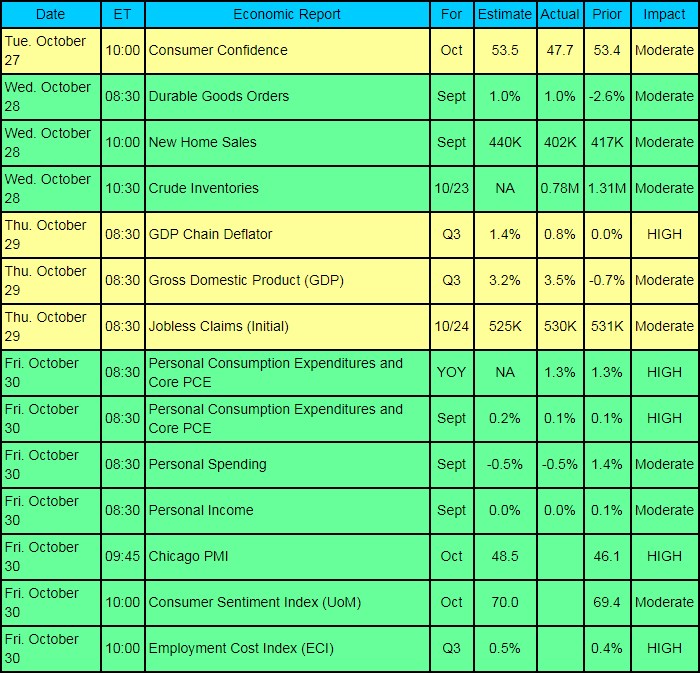

Another record sized round of Treasury auctions are on tap this week – and the massive amounts of supply that continue to flood the market can cause home loan rates to move higher, if there is ultimately not enough demand to sop up all the supply. Additionally, there are several economic reports which could be market movers. Tuesday brings both the Consumer Confidence and Durable Goods Reports, the latter of which gives us an update on consumer and business consumption and buying behavior via data on items that are non-disposable, such as cars, furniture, appliances, games, cameras, business equipment, etc.

On Wednesday, there will be more news on the housing front with the New Home Sales Report, while Thursday brings another Initial Jobless Claims Report. Thursday also brings a read on the economy with the Gross Domestic Product (GDP) Report, which is the broadest measure of economic activity. And the week could end with a bang, as Friday brings the Fed’s favorite gauge of inflation, the Core Personal Consumption Expenditure (PCE) Index, found within the Personal Income Report.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result.

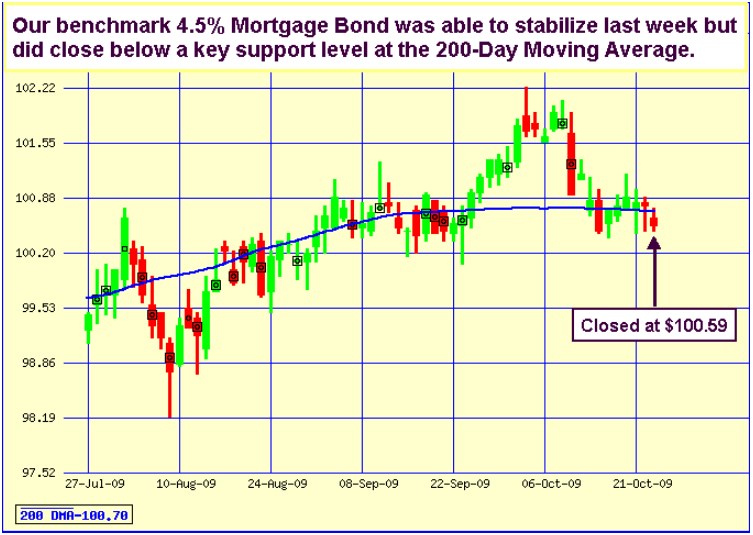

As you can see in the chart below, Bonds held their ground for most of the week but ultimately were unable to remain above a key technical support level. I’ll be watching closely to see what happens in the week ahead – and as always, reach out to me if you or others in your network need more information or questions answered…I’m here to help.

Chart: Fannie Mae 4.5%% Mortgage Bond (Friday Oct 23, 2009)

The Mortgage Market View… ![]()

H1N1: Information is the Best Defense!

Despite predictions from researchers at Purdue University that the H1N1 outbreak will peak this week, the reality is that it won’t be going away any time soon. Let’s not forget that the news is filled with shortages of the vaccine, as the number of H1N1 cases continues to surge across the country. And federal officials have warned that a second, larger outbreak could occur in early January.

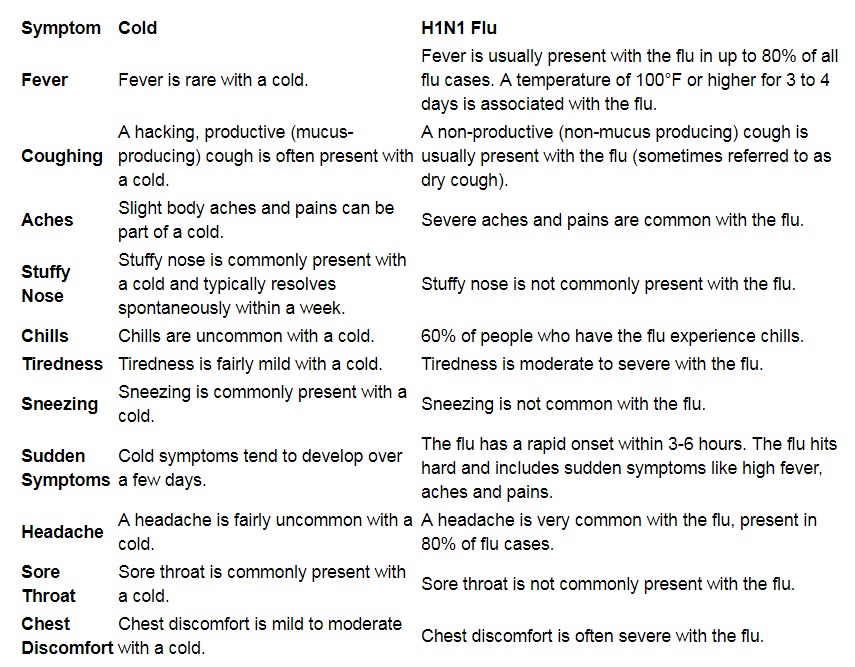

The reality is that the best way to stop the spread of H1N1 is to know the symptoms and to take steps to protect yourself-and others-from it. The following information can help.

What are the symptoms of H1N1… and how are they different from the common cold?

If you think you have the H1N1 flu, you should take a few common-sense steps to protect your friends, family members, and coworkers. For instance, if you feel sick, stay home until you feel better and have gone at least 24 hours without relying on medicine to break your fever.

In addition, wash your hands, linens, dishes, and so on thoroughly. And cover your mouth and nose with a tissue when you cough or sneeze–and then throw the tissue away immediately. Finally, if you have to share a small space with other people, consider wearing a face mask to help make sure you don’t spread the flu to the people around you.

Follow these steps and monitor your symptoms to help stop the spread of H1N1…and remain happy and healthy!

The Week’s Economic Indicator Calendar arrow ![]()

Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise.

Economic Calendar for the Week of October 26 – October 30

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

As your trusted advisor, I am sending you the Manhattan Mortgage Company Mortgage Weekly Update because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email: ejarrett@manhattanmortgage.com

If you prefer to send your removal request by mail the address is:

Eve Robin Jarrett

Manhattan Mortgage

75 Main Street, 2nd Floor

East Hampton, NY 11937

The Manhattan Mortgage Company is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. The Manhattan Mortgage Company does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.